Exciting Summertime Benefits period from CRA

(Disclaimer: The following article is only for information purposes and does not constitute any kind of tax advice. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.)

As the warm embrace of summer envelops Canada, the Canada Revenue Agency (CRA) is once again extending a helping hand to its citizens. With a host of exciting updates and new benefits on the horizon, this article aims to keep you well-informed and prepared to make the most of the CRA's summertime benefit period. From dental care opportunities and inflation relief to year-round support for low-income workers, this comprehensive guide will walk you through the various benefits and credits that can positively impact your financial well-being during this vibrant season. Get ready to enjoy your summer adventures while staying informed about the valuable assistance the CRA has in store for you.

New Opportunities for Dental Care

As summer arrives in Canada, it brings not only warm weather and outdoor adventures but also new opportunities for financial support from the Canada Revenue Agency (CRA). One such opportunity is the Interim Canada Dental Benefit, which opens its second period on July 1. Whether you've taken advantage of this benefit before or not, you can apply for it again this year. Eligible families with young children can receive up to $650 per child for dental care services from July 1, 2023, to June 30, 2024. Find out if your child qualifies and how to apply at Canada.ca/dental.

Alleviating the Burden of Rising Prices

The rising costs of essential items like food and personal care products can put a strain on the finances of many Canadians. To address this concern, the Canadian government introduced the Grocery Rebate payment in Budget 2023. This payment is aimed at helping low- and modest-income individuals and families cope with inflation. On July 5, 2023, the Grocery Rebate was issued alongside the regular GST/HST credit payment for July 2023. It is expected to offer up to $2.5 billion in inflation relief to approximately 11 million Canadians and families. Learn more about this rebate at Canada.ca/grocery-rebate.

Year-Round Support for Low-income Canadian Workers

Good news for individuals and families with low incomes: Canada workers benefit (CWB) will now be available throughout the year. As part of the Advanced Canada workers benefit (ACWB), half of the 2022 CWB allotment will be paid out in quarterly installments in July, October, and January. The remaining amount will be reconciled upon filing the 2023 tax return next spring. This change, announced in the 2022 Fall Economic Statement, aims to provide much-needed support for expenses at any time of year. Learn more about the CWB and ACWB at Canada.ca/canada-workers-benefit.

Expanding the Climate Action Incentive to the Atlantic provinces

Residents of Newfoundland and Labrador, Nova Scotia, and Prince Edward Island will join their counterparts in Ontario, Manitoba, Saskatchewan, and Alberta in receiving the carbon tax refund, also known as the Climate Action Incentive payment. This expansion will take place between July 14 and July 21, benefiting those affected by the federal pollution pricing system. The payment aims to alleviate the financial impact of environmental initiatives on Canadians, providing additional support during the summer months. For province-specific payment amounts and eligibility criteria, visit Canada.ca/cai-payment.

Annual Adjustments to Support Canadian Families

Each July, the CRA adjusts federal benefits and credits to keep pace with the rising cost of living. These adjustments ensure that benefits, such as the Canada child benefit (CCB) and the GST/HST credit, continue to offer essential financial support to eligible recipients. If your family situation has changed, such as welcoming a new baby or experiencing a relationship change, your benefits may also be adjusted accordingly. It's important to check your Notice of Redetermination for specific details about your account and benefit adjustments. You can find the same in your CRA My Account. (In case you do not have access to CRA My Account, click here for instructions to register for CRA My Account). Moreover, many benefits can be used to pay down government debt, except for the CCB, which can only be used to pay down CCB debt.

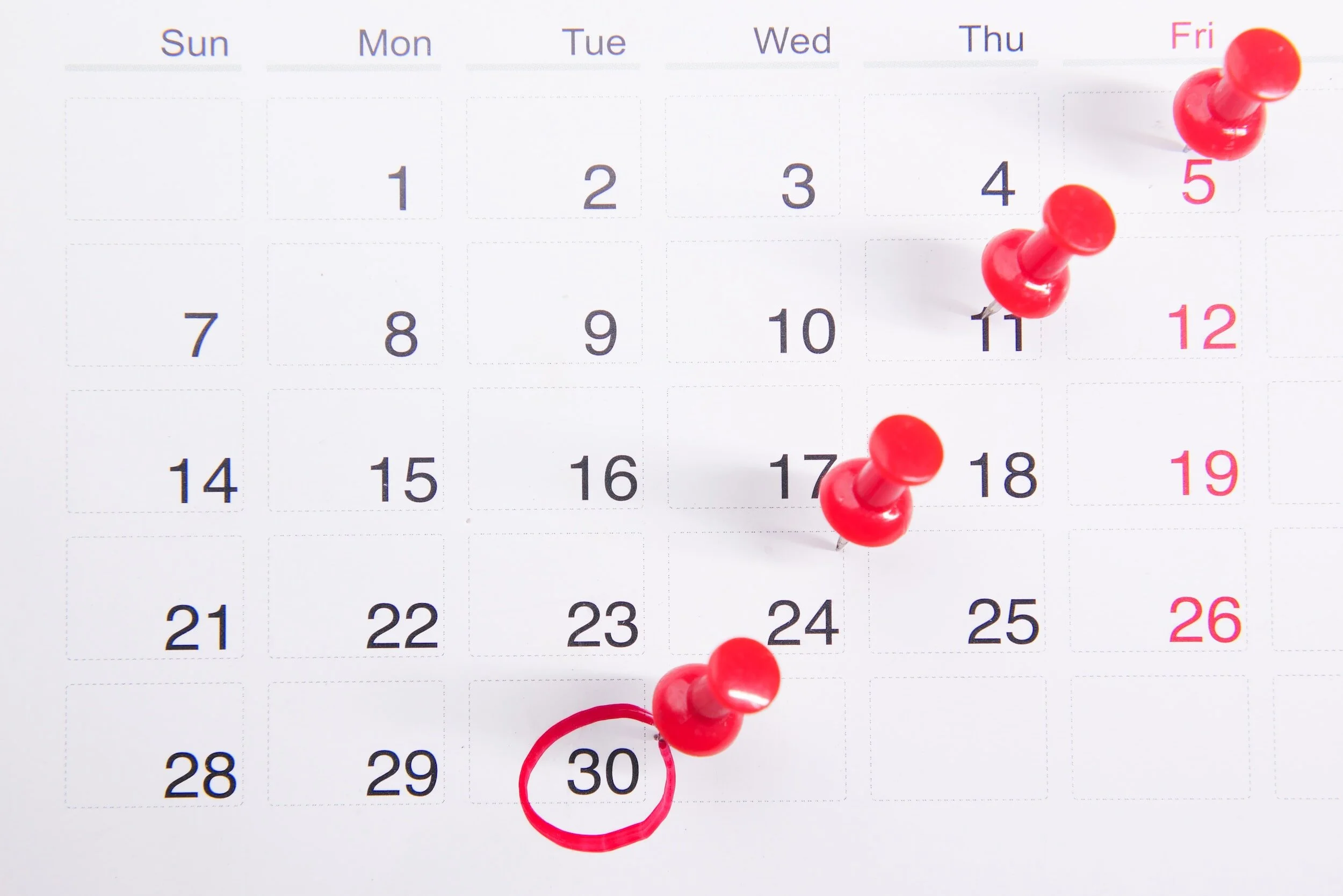

Stay Informed for a Rewarding Summer

As summer unfolds in Canada, don't miss out on the exciting opportunities and support available from the CRA. From dental benefits to inflation relief and year-round support for low-income workers, these initiatives can make a significant difference in your financial well-being. Mark the important dates on your calendar and remember to check the CRA website for updates and further information. The CRA is committed to helping Canadians thrive during the summertime benefit period and beyond.

July 1: Applications open for period two of the Interim Canada Dental Benefit.

July 5: Grocery Rebate and GST/HST credit payment day.

July 14 - 21: Climate action incentive payments issued for residents of Newfoundland and Labrador, Nova Scotia, and Prince Edward Island.

July 20: Canada child benefit payment day.

July 28: First quarterly payment of the Advanced CWB.

Make sure you register on CRA My Account to see what benefits you are eligible for and when you can receive it.

Don’t forget to follow us on social media for the latest updates and deadline reminders: